child tax credit 2022 schedule

Child Care Tax Credit 2022 Schedule. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Additional New York State Child And Earned Income Tax Payments

Havent received your payment.

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

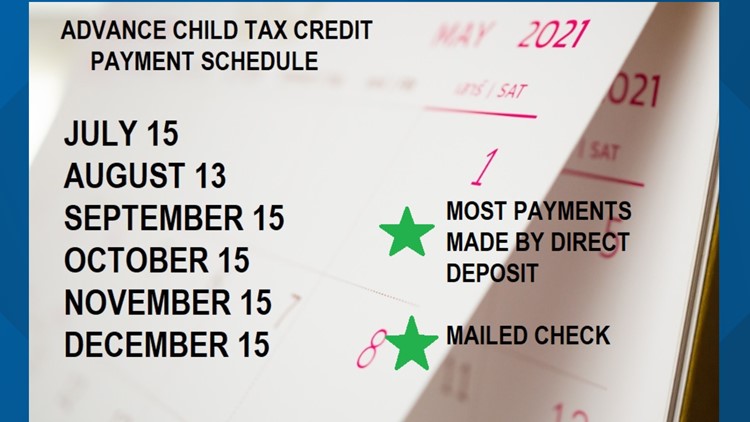

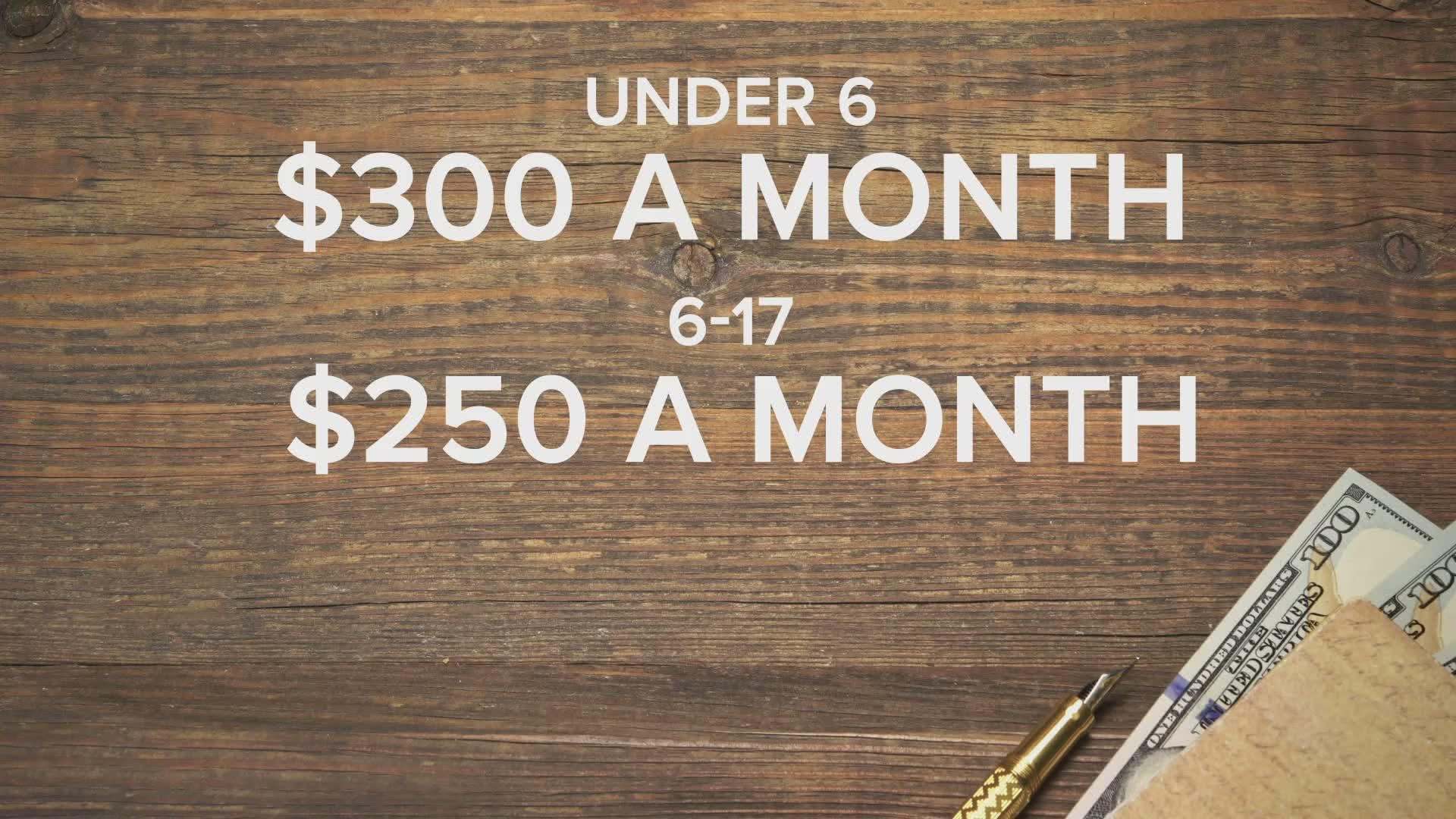

. Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child. Only file Schedule C if you had profit or loss from your business. You will receive either 250 or 300 depending on the age of.

About Catch Up Payments. 28 Refundable child tax credit or additional child tax credit from. You can get financial support to help with the costs of your childs tutoring supplies or equipment during the 202223 school year.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. All payment dates. Have been a US.

The size of the credit will be cut in 2022 with full payments only going to families that earned enough income to owe taxes a policy choice that will limit the benefits for the. The maximum child tax credit amount will decrease in 2022. Families could be eligible to.

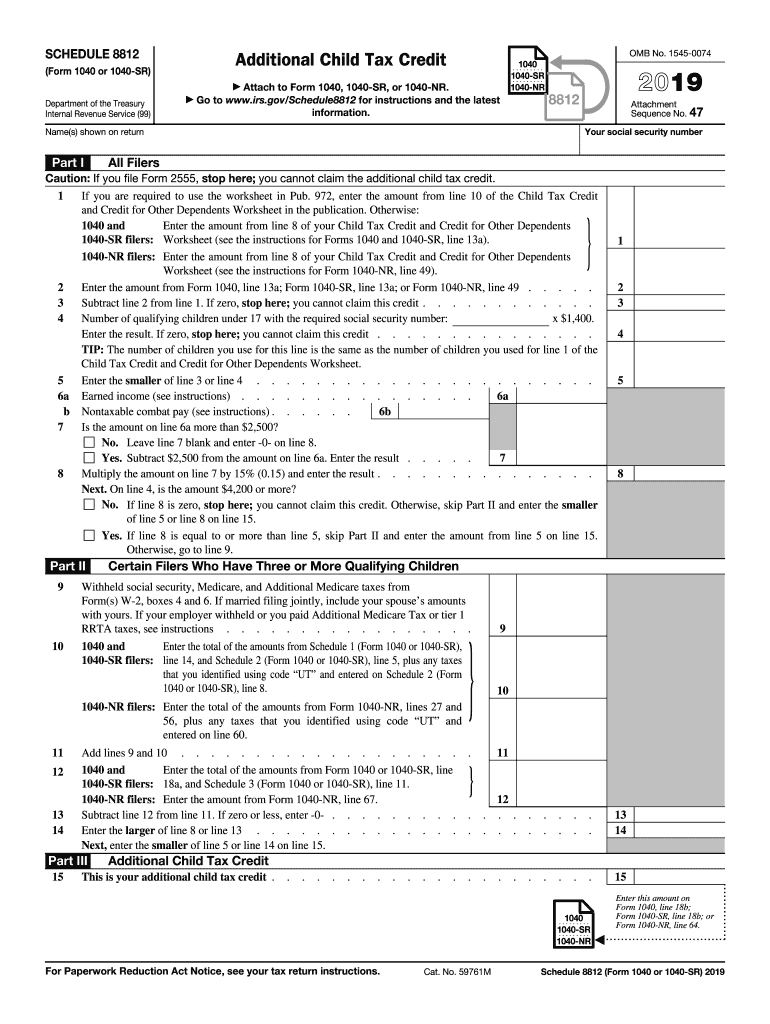

Wait 5 working days from the payment date to. For more information about the Credit for Other Dependents see the instructions for Schedule 8812 Form 1040 PDF. If youre operating as a sole proprietor but had no profit or loss during the tax year Schedule C isnt needed.

How much of the Child Tax Credit can I claim on. Why file Schedule 8812. View Screenshot 2022-09-19 64155 PMpng from PE 450000 at Woodgrove High School Purcellville VA.

You must report the monthly payments. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. The advance child tax credit received from july through december last year amounted to up to 1500 or up to 1800 for each child.

If youre received advanced child tax credit payments at any time during 2021 fill out Schedule 8812 and attach it to your return. The Child Tax Credit was expanded for tax year 2021 so parents can get half of the credit early before filing their taxes in early 2022 through advanced monthly payments. The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendozas office said in a news release.

Do You Have Kids The Deadline To Claim Your Child Tax Credit Is Approaching Wric Abc 8news

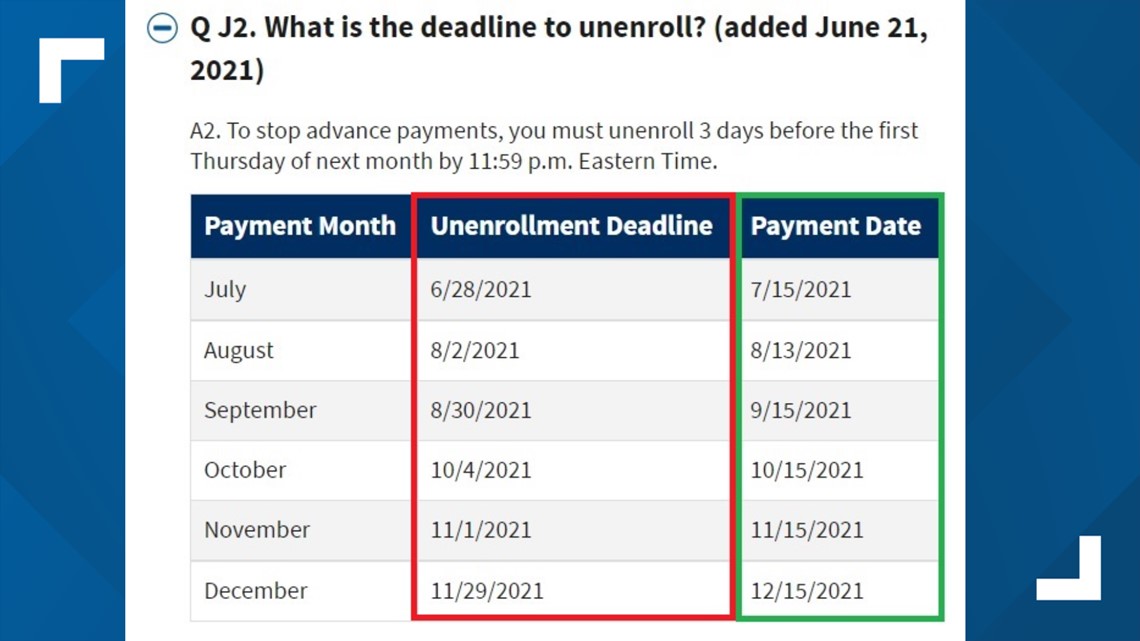

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

Child Earned Income Tax Credits 02 16 2022 News Auburn Housing Authority Auburn Alabama

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit Irs 2015 Form Fill Out Sign Online Dochub

About The 2021 Expanded Child Tax Credit Payment Program

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit 2022 What We Know So Far

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Tax Refund Schedule 2022 If You Claim Child Tax Credits The Us Sun

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Will You Have To Repay The Advanced Child Tax Credit Payments

Do You Have Kids The Deadline To Claim Your Child Tax Credit Is Approaching Wric Abc 8news

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Connecticut Families Can Start Applying Today For The State S Child Tax Rebate

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com