idaho education tax credit 2021

Continuing education credit may be. Credit for Attending the Licensure Board Meetings.

Ability To Respond Horizonpwr Solar Solar Energy Facts Fastest Growing Industries Solar Panel Installation

Idahos projected 19 billion surplus they argued puts the state in a once-in-a-lifetime position to return a huge chunk of tax dollars to Idahoans and still make 500 million in proposed investments in education and transportation.

. Idaho Education Tax Credit for 2015-2020. Listed below are the credits that are available to you on your Idaho return. You make a gift to Idaho Botanical Garden a museum.

IBOLIBOLIDAHOGOV wwwIBOLIdahogov IAC Archive 2021. At the election of the taxpayer there shall be allowed subject to the applicable limitations provided herein as a credit against the income tax imposed by chapter 30 title 63 Idaho Code an amount equal to fifty percent 50 of the aggregate amount of charitable. Qualified withdrawals from a 529 account can be used toward 1.

Educational Contribution Credit - limited to the smallest of one-half donated. If their tax liability was 5000 the credit reduces it to 4000. 20 tax credit for Idaho employers of up to 500 per employee per year for contributions made to the employees IDeal account 4.

Qualifying expenses from a 529 Education Savings account now include K-12 and private schools. Heres how it will work. Electricty Kilowatt Hour Tax.

The college entrance exam requirement has been waived for students graduating during the 2021-2022 school year including summer 2022 term. The tax levies are for the tax year 2020 school year 2020-2021 and are expressed as a ratio xxxxxx of property valuation. Idaho Education Tax Credit.

Since the Idaho child tax credit uses the federal definition Idaho Form 40 line 25 page 9 in the instructions and Idaho Form 43 line 46 page 21 in the instructions should now read. It doesnt have to cost a lot to make a big difference at Bishop Kelly. January 19 2021 Agenda Minutes February 16 2021 Agenda Minutes March 16 2021 Agenda.

This credit is available regardless of whether or not you itemize deductions. As an Idaho tax payer your donations to the University of Idaho and the College of Law may be eligible for a 50 percent education tax credit. The state provides a tax.

The two core priorities for Idaho throughout this school year are addressing the academic impact of lost instructional time and the challenges to student staff and community wellbeing created by COVID-19. Grocery Credit - 100 per exemption An additional 20 may be claimed if you are over age 65 and a resident of the state. The State of Idaho provides an income tax credit to taxpayers who give to schools or educational organizations and museums like Idaho Botanical Garden through the Idaho Education Tax Credit.

The top rate for individuals is now 6925. 2021 Meeting Dates Agendas Minutes. Income tax credit for charitable contributions Limitation.

Idaho Education Tax Credit. Skip to main. For example a couple filing a joint return can claim a credit up to 1000 on a contribution of 2000 or more.

Your rebate will be based on the 2020 return but youll receive only half of the rebate amount. Idaho Education Tax Credit Home. December 29 2021 By Cascade Library Staff.

Be age 17 or under as of December 31 2021. Business income tax return changes. And we continue our focus on improving literacy for our youngest students and preparing older students for careers.

Certain room and board costs. Governor Little proposes paying off state building debt clearing out one-third of backlogged repairs in infrastructure and bringing rainy-day funds to a. E911 - Prepaid Wireless Fee.

For those who do itemize a donation to the U of I allows income tax deductions on both your state and federal returns. Find information for High School Graduation Requirements at the Idaho State Department of Education. 12 of the total continuing education credits required for a renewal period.

Congress temporarily increased the age of a qualifying child from 16 and under to 17 and under for the federal definition of a qualifying child. The state tax credit is up to 50 or 1000 of your donation for married couples 500 for individuals. Idahos surplus is the highest its ever been 19 billion and counting which represents 40-percent of the General Fund.

Make a gift today and earn your Idaho Tax Credit this year while creating a significant impact at Bishop Kelly. This credit is available regardless of whether or not you itemize deductions. The property must have a useful life of three years or more and be property that youre allowed to depreciate or amortize.

Little and House Republicans said the bill is the largest tax cut in state history based on dollars. Object Moved This document may be found here. Take a minimum of 46 high school credits.

This publication provides a tabulation of tax levies for Idaho public schools obtained from information supplied by the Boards of County Commissioners and the State Tax Commission. For those who do itemize the deductions may become even greater. January 26 2022 By Cascade Library Staff.

Fuels Taxes and Fees. 50 of tax on line 42 of form 43. The individual income tax rate has been reduced by 0475.

As an Idaho tax payer your donations to the University of Idaho College of Agricultural and Life Sciences may be eligible for a 50 percent education tax credit. ARCHIVE Page 2 Table of Contents 241801 Rules of the Real Estate Appraiser Board. IT Help Desk.

Visit Idahos Legislature website for More Information Idaho Statute 63-3029A. State requirements include that all students. Current Book Review 2021 Archives.

Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child. Investment Tax Credit 2021 Qualifying Depreciable Property Idaho generally follows the definition of qualified property found in the Internal Revenue Code IRC sections 46 and 48 as in effect before 1986. Withdrawals are limited to tuition payments up to 10000 per year per student.

Idaho State Tax Savings 7 19 37 74 Idaho Tax Credit 50 125 250 500 Total Savings for the Year 82 207 412 824 Your actual cost of the gift 18 43 88 176 Idaho Individuals may take up to 50 of a gift up to 1000 a tax credit of up to 500. It will be split equally between you and your ex-spouse following Idaho Community Property law 32-906. My address has changed since I filed my 2021 tax return.

You filed as Married Filing Joint in 2020 but filed as Single or Head of Household in 2021.

Team Motivation Horizonpwr Team Motivation Solar Energy Facts Motivation

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

Meals Entertainment Deductions For 2021 2022

Idaho State Senator Floats Plan That Would Eliminate School Supplemental Levies Idaho Capital Sun

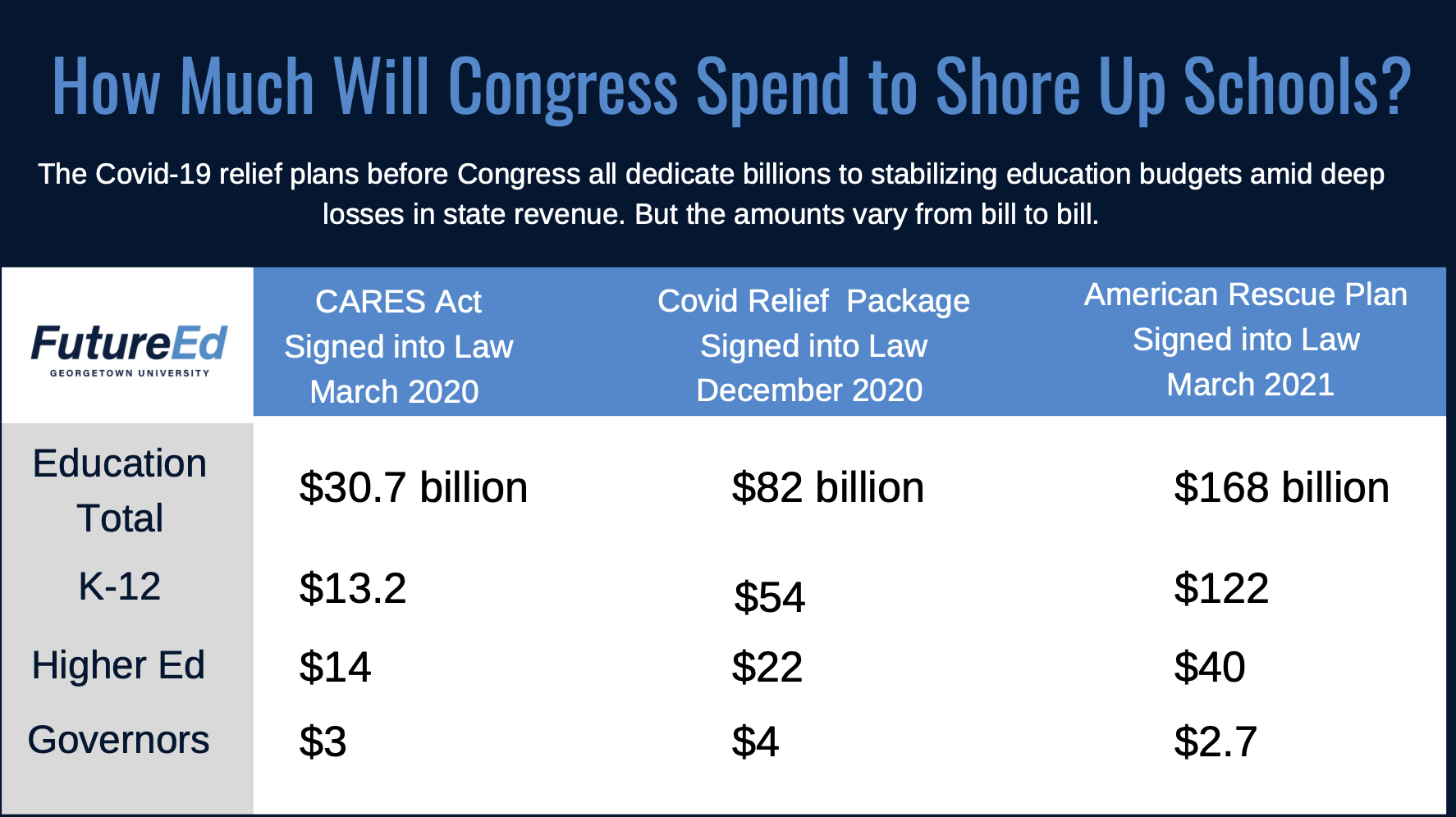

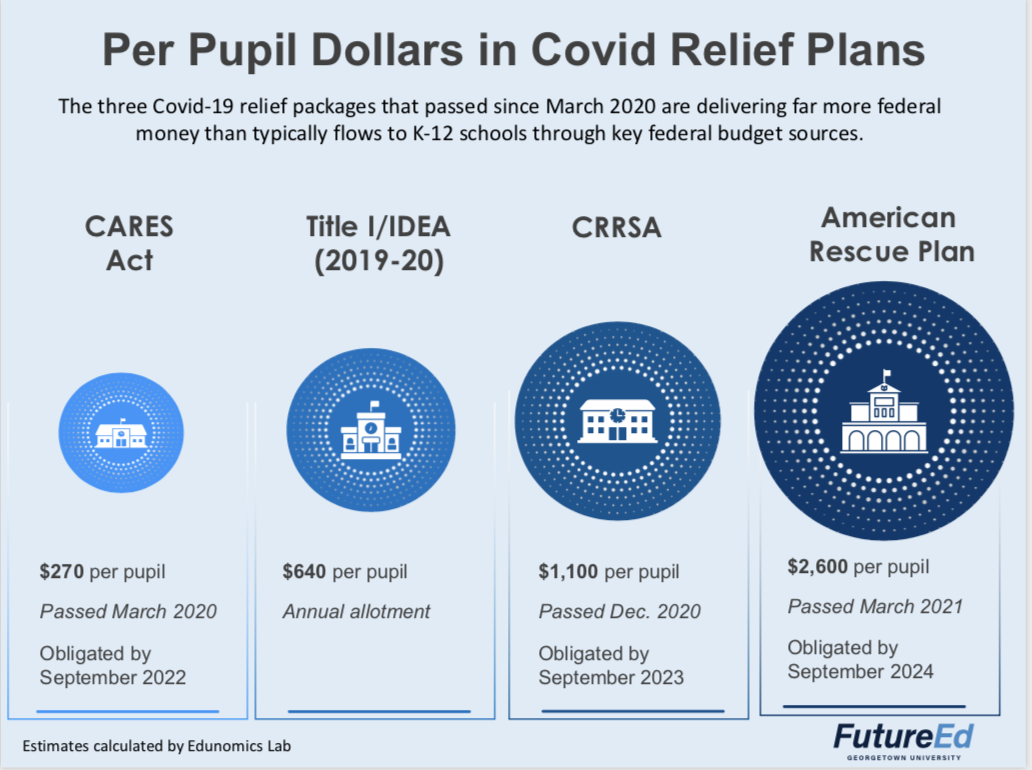

What Congressional Funding Means For K 12 Schools Futureed

Quits Big Raises And Severe Labor Shortages The U S Jobs Market In 2021 The Washington Post

Idaho Receiving 5 6 Billion Through Arpa Now The Hard Work Begins Idaho Reports

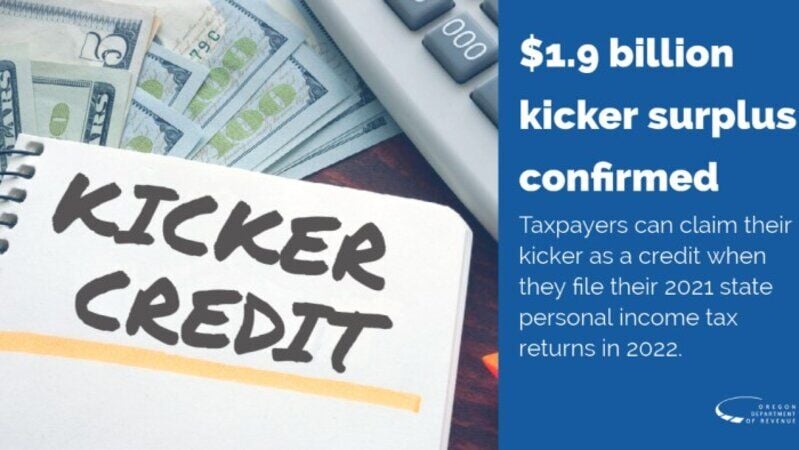

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

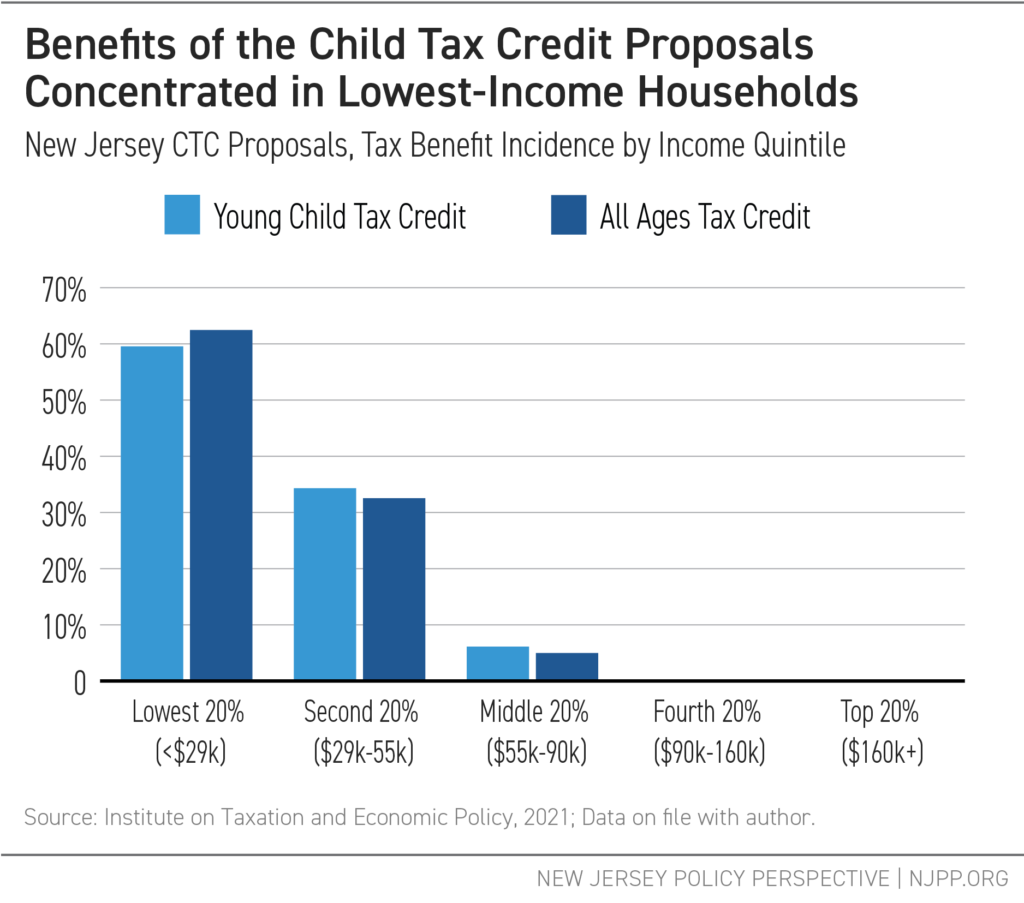

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

No Fresh Start In 2021 Will States Let Debt Collectors Push Families Into Poverty As Pandemic Protections Expire Web Version National Consumer Law Center

Sample Of A Research Proposal Introduction In 2021 Persuasive Essay Topics Essay Topics Essay

Local Law Group In 2021 Legal Services Estate Planning Estate Law

How To Build A Media List For Publicity Submissions In 2021 Online Business Marketing Online Marketing Strategies Public Relations Strategy

Schooling In America Polling Dashboard Edchoice

What Congressional Funding Means For K 12 Schools Futureed

Ap Macroeconomics Unit 1 Exam Review Jeopardy Template Exam Review Macroeconomics Jeopardy Template

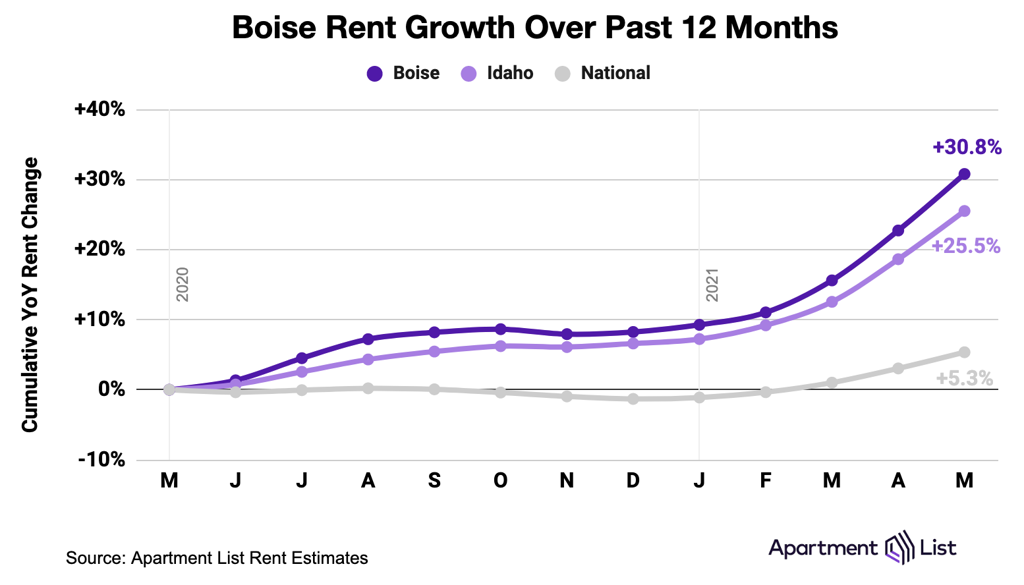

Boise S On Fire Rental Market Pushing Renters To Edge Local News Idahopress Com